Banks sell mortgage insurance, but independent experts say you shouldn’t buy it

Banks sell mortgage insurance, but independent experts say you shouldn’t buy it

When buying a home, there is little that is more essential than the insurance that covers the liablity. With 48% of home foreclosures being the result of injury or illness, paired with the fact that the probability that your average 25 year old has a 43% chance of becoming disabled, a 20% chance of becoming critically ill, and a 52% chance of encountering death, disability, or critical illness prior to the age of 65, having to exercise the use of any coverage you may have in place is common.

Health insurance may not be top of mind for those of you who are young, especially those without a family or large debt. But getting ahead of the curve of inevitabilities and circumstances both foreseen and unforeseen can have you thanking yourself down the road by locking in low rates in your younger years. Speak to one of our representatives at Crossgrove & Company to have your optimal options laid out for you.

Tips for 2 tough conversations with clients

Tips for 2 tough conversations with clients

As with anything, circumstances change with time. That’s why, at Crossgrove & Company, we scan the market in full with your specific needs in mind to bring you the optimal option(s) available. Contact us today to find out where gaps in your coverage may exist, and how best to go about filling in the blanks.

Being prepared for potential misfortunes can save you much more than just money. Contact us at Crossgrove & Company and have one of our experts ask the right questions to make the right recommendations when it comes to protecting yourself and your loved ones. From life, to critical illness, to disability, to travel and beyond, we have access to all your insurance needs.

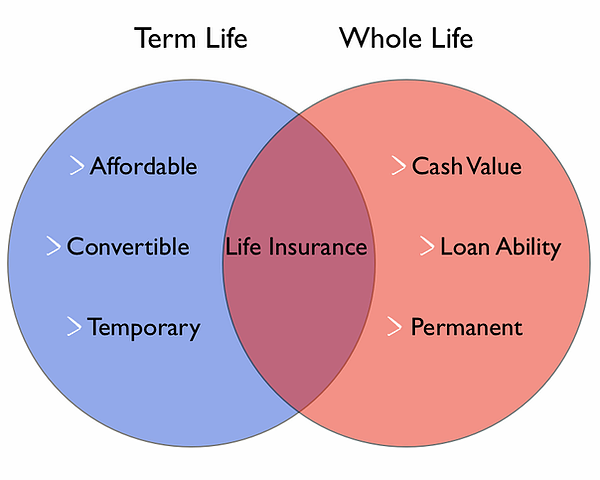

At Crossgrove & Company, we work with all carriers in Canada and spend the time to determine which life insurance policy is best for you. Whether it be term, universal, or whole life insurance, we analyze each quote to bring you the best results within your budget.

Even among participating policies, dividends aren’t guaranteed. The amount of the dividend payout in a given year depends on the operating experience of the insurance carrier in that year. Choosing the right carrier for an insurance policy can matter when it comes to dividends. At Crossgrove & Company, we have the experience necessary to make the right choices when it comes to choosing carriers and ultimately, how to bring you the most value. Contact us today!

The current staffing crisis in health care has reignited debate over privatization of the Canadian system — and while more needs to be done to take the pressure off hospitals, critics say more private care is not a "simple solution." Putting policies in place such as critical illness and disability insurance is a key solution to this potential complication. Contact us at Crossgrove & Company to be matched with a policy that's best for you.

Life insurance can be more than insuring your life. Did you know that you can also build wealth via life insurance? Find out how by contacting us at Crossgrove & Company. We'll walk you through the process of strategically choosing the policy or policies that are right for you!

Clients should ask themselves if they get sick and can’t work, will they be able to take care of themselves, their family, and protect their financial well-being? Let us at Crossgrove & Company guide through acquiring the optimal policies for your unique situation.

Many of us have disability insurance through our employee benefits but, all told, only 8% of working Canadians pay for coverage out of their own pocket.

In this Q&A, Jim talks about the realities of disability insurance, the shortfalls of group benefits, and the importance of protecting yourself from life’s worst-case scenarios.

For Canadians wishing to escape the traditional 9-to-5, the opportunities are endless. Whether it’s starting their own business or taking an early retirement to enjoy life, the options are as exciting as they are varied. While these choices may provide more freedom and flexibility, there’s something that gets left behind when workers embark on a new career or life path: group health benefits offered by their former employers. Contact us at Crossgrove & Company to explore those options and beyond!

Dying in Canada is costing a fortune – and worse, it’s not how we want to go

Dying in Canada is costing a fortune – and worse, it’s not how we want to go

“Canadians spend more on end-of-life care than other high-income countries, including the U.S., yet we achieve poor results compared to most.” Each year, about one in every 100 Canadians dies. The vast majority of those deaths, 80 per cent, are people over the age of 65. And most die of chronic illnesses like cancer, cardiovascular disease, diabetes, and COPD. Contact us at Crossgrove and Company where you'll receive sound advice when it comes to relieving the costs associated with not only critical illnesses, but what they often lead to: death.

Disability Insurance Protects Clients As Well As Advisors

Disability Insurance Protects Clients As Well As Advisors

Although each client has different financial needs and obligations, one of the first questions to ask clients is “What is your most valuable asset?” Some may say it is a home or investment; however, their most valuable asset is the ability to work and earn a living. Without an income, it becomes hard to afford even regular living expenses. Contact us at Crossgrove & Company and let us show you how to protect the investments that are upheld by your biggest asset: you!

Keep what's yours

Keep what's yours

Life insurance is by far the most misunderstood asset class in Canada. Most people only see it as a benefit to their dependents or their already successful family members. But almost all the wealthiest families in every industrialized nation in the world see this instrument as an asset to use for themselves, not just the next generation. Contact us at Crossgrove & Company today! We'll help you find the policy that best fits your financial goals in a way that has you keeping more of what you've earned!

Strong appetite for virtual health-care offerings

Strong appetite for virtual health-care offerings

The product became more important during the coronavirus pandemic as Canadians sheltered in place to avoid infection and investors simultaneously pinned their hopes on technology companies at dizzying rates. Contact us at Crossgrove & Company to find out more about products like Members Health, where doctors are at your fingertips 24/7...

You need long-term disability insurance. Now what?

You need long-term disability insurance. Now what?

Long-term disability insurance likely isn’t something you ever want to be in a position to need, but if ever you do need it, you’ll be grateful it’s there. Like short term-disability insurance, it provides financial assistance to an employee who is unable to work because of an accident, injury or illness. True to its name, long-term disability (LTD) payments cover a long period of time—as much as several years. Contact us at Crossgrove & Company to get a free assessment of your needs and let us take care of the application process for you!

My husband spent his dying days worried about finances. No one with cancer should live that way..

My husband spent his dying days worried about finances. No one with cancer should live that way..

'When we found out his cancer had become terminal, our lives were once again upended. One of the changes that had a profound impact on David was his loss of income.' Have peace of mind by contacting us at Crossgrove & Company and let us make reviewing and applying for a critical illness policy a breeze.

Half of Canadians see anxiety and depression as disabilities: survey

Half of Canadians see anxiety and depression as disabilities: survey

“Diagnosed depression and anxiety can indeed be debilitating, but the findings show that most of us don’t truly understand the impact of something until we’ve experienced it ourselves,” said Maria Winslow, senior director of life and health at RBC Insurance, in a press release. “There is still a large portion of Canadians who do not consider the sometimes invisible ailments of depression and anxiety as disabilities, yet mental illness causes the majority of disability claims at RBC Insurance.” Contact us today to ensure that yourself, your loved ones, or perhaps even your employees are well covered!

Foresters Financial launches new critical illness insurance

Foresters Financial launches new critical illness insurance

With 48% of home foreclosures being the result of injury or illness, Foresters Financial™, the 146-year-old fraternal life insurer, announces the launch in Canada of Live Well Plus and Live Well - critical illness insurance products focused on the needs of under-served everyday Canadian families. The two offerings represent a comprehensive refresh of critical illness insurance at Foresters with new pricing and expanded benefits. Talk to one of our licensed advisors today!

Why buying life insurance for your parents can make financial sense

Why buying life insurance for your parents can make financial sense

If your parents don’t have an insurance policy or the funds to pay their own way in their later years, you can buy life insurance for your parents yourself, assuming they’re on board and can qualify for coverage. Contact us today!