A Proactive Approach to Disability Insurance

A Proactive Approach to Disability Insurance

Whether it comes to groups or individuals, Crossgrove & Company ensures that its clients take a proactive approach to coverage. A unique feature of ours is that we offer free consultations to our group client employees in order to educate them on the gaps that may exist between their group coverage and what they may need personally. Contact us today to see what we can do for you!

Happy New Year! Follow our Crossgrove & Company blog and social media platforms (Linked-in, Facebook, Instagram) for up-to-date financial advice to start 2023. Better yet, contact us and let us tailor a plan specific to your needs!

Being prepared for potential misfortunes can save you much more than just money. Contact us at Crossgrove & Company and have one of our experts ask the right questions to make the right recommendations when it comes to protecting yourself and your loved ones. From life, to critical illness, to disability, to travel and beyond, we have access to all your insurance needs.

Group Benefits Trends in 2023

Group Benefits Trends in 2023

Taking a look at some of the statistics and trends in order to formulate the best course of action for each organziation when it comes to group benefits is a pillar of our operations at Crossgrove and Company. Here are some numbers that organizations and their brokers may want to consider as we enter 2023, as well as an example of how some firms are using current conditions to optimize their group benefits plan.

Life insurance can be more than insuring your life. Did you know that you can also build wealth via life insurance? Find out how by contacting us at Crossgrove & Company. We'll walk you through the process of strategically choosing the policy or policies that are right for you!

12 Services Many Financial Advisors Offer (That Clients May Not Know About)

12 Services Many Financial Advisors Offer (That Clients May Not Know About)

Many clients view their personal financial advisors as solely focused on investments and retirement. Businesses may reach out to their advisors only at tax time. However, there are many other impactful ways both business and personal financial advisors can assist and guide their clients. Additionally, there are new technologies and options that financial advisors can leverage to help their clients achieve optimal results. Let our experts at Crossgrove & Company get you on the right track to your future.

Canadian employers face conflicting pressures amid a pandemic-driven labour shortage. While inflation, economic volatility and rising costs are squeezing organizations’ budgets, employees also want more from their prospective employers. But with the fierce competition for talent, employers also can’t afford to skimp on employee benefits. At Crossgrove & Company, we bring our clients material savings year over year without sacrificing benefits. Contact us to see what we can do for you and your organization!

According to financial services provider Primerica, Inc. in its Canadian Financial Security Monitor, a national survey that measures how Canadian families view their finances, Canadians with access to a financial adviser feel more positive about their financial future. Contact us at Crossgrove & Company and allow us to provide you with the peace of mind you deserve!

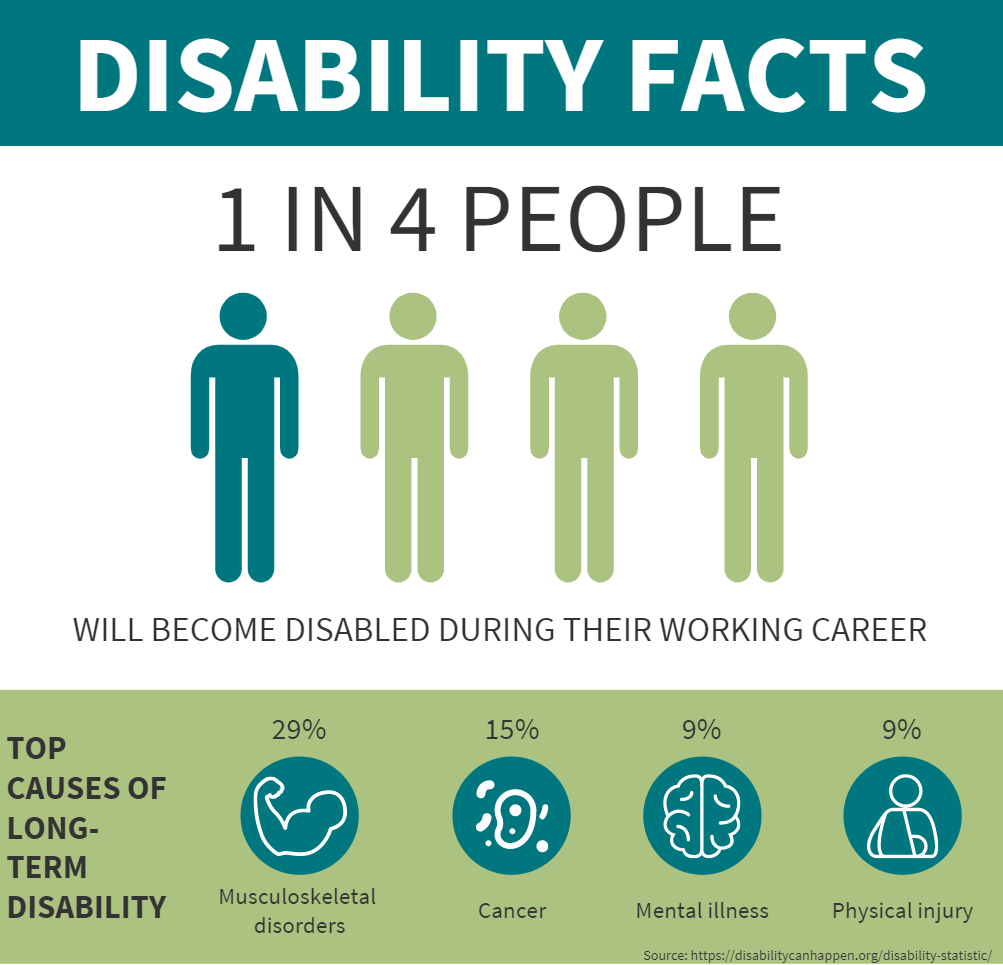

Clients should ask themselves if they get sick and can’t work, will they be able to take care of themselves, their family, and protect their financial well-being? Let us at Crossgrove & Company guide through acquiring the optimal policies for your unique situation.

Employers seeing paramedical claims return to pre-pandemic levels

Employers seeing paramedical claims return to pre-pandemic levels

As the coronavirus crisis enters an endemic phase, employers are beginning to see a return to pre-pandemic levels in paramedical benefits’ usage. Let us at Crossgrove & Company show you how best to go about premium stability for group benefits in years with high claims.

Many of us have disability insurance through our employee benefits but, all told, only 8% of working Canadians pay for coverage out of their own pocket.

In this Q&A, Jim talks about the realities of disability insurance, the shortfalls of group benefits, and the importance of protecting yourself from life’s worst-case scenarios.

In advance of Financial Literacy Month, IG Wealth Management (IG) today released a study on Canadians and personal financial planning. According to the study, Canadians are feeling uncertain when it comes to their personal finances. However, those who use a financial advisor are much more likely to feel secure and "financially healthy" as they navigate current market conditions. Crossgrove & Company can help with not just how secure you feel, but also with the results you achieve.

For Canadians wishing to escape the traditional 9-to-5, the opportunities are endless. Whether it’s starting their own business or taking an early retirement to enjoy life, the options are as exciting as they are varied. While these choices may provide more freedom and flexibility, there’s something that gets left behind when workers embark on a new career or life path: group health benefits offered by their former employers. Contact us at Crossgrove & Company to explore those options and beyond!

Canada’s Big Five banks have a dominating share of wealth management services in this country. But they often provide a commoditized, “cookie-cutter” approach to investment solutions that don’t always suit the needs of high-net-worth Canadian investors. In recent years, a new offering has emerged – one that allows investment advisors to deliver uniquely customized solutions to meet the desired outcomes of their clients.

88% of benefits plan sponsors satisfied with virtual health-care offerings

88% of benefits plan sponsors satisfied with virtual health-care offerings

A majority (88 per cent) of benefits plan sponsors are very (34 per cent) or somewhat (54 per cent) satisfied with their organization’s virtual health-care offerings, up from nearly three-quarters (74 per cent) in 2021, according to the 2022 Benefits Canada Healthcare Survey. Here, at Crossgrove and Company, Member's Health has become a very popular virtual health care service amongst ourselves as well as our clients!

Are We In The Final Inning?

Are We In The Final Inning?

It now seems possible, perhaps probable, that the dollar will take a reprieve from its parabolic rally, if more central banks start to imitate in a cooperative manner what the aforementioned ones have recently done.

Dying in Canada is costing a fortune – and worse, it’s not how we want to go

Dying in Canada is costing a fortune – and worse, it’s not how we want to go

“Canadians spend more on end-of-life care than other high-income countries, including the U.S., yet we achieve poor results compared to most.” Each year, about one in every 100 Canadians dies. The vast majority of those deaths, 80 per cent, are people over the age of 65. And most die of chronic illnesses like cancer, cardiovascular disease, diabetes, and COPD. Contact us at Crossgrove and Company where you'll receive sound advice when it comes to relieving the costs associated with not only critical illnesses, but what they often lead to: death.

Do you need health and dental insurance in retirement?

Do you need health and dental insurance in retirement?

About 2.2 million Canadians over 65 years old have supplementary health insurance coverage for drugs/dental through individual or group benefit plans, according to the Canadian Health and Life Insurance Association. Still, there are millions left wondering if health and dental insurance are really necessary in retirement – and what options are out there. Acquiring and retaininng quality employees has much to do with the group benefits that an organization offers its employees. Whether you're an employer or an individual, Crossgrove & Company can guide you in making sound, affordable decisions when it comes to health coverage for yourself, your family, and even your employees. Contact us today!

For baby boomers who manage their own nest eggs, a risk is looming that has nothing to do with stock prices or interest rates. The risk is cognitive decline, which can rob them of their judgment, often without much warning. Contact us at Crossgrove & Company to avoid the pitfalls of cognitive decline and have peace of mind knowing that your financial decisions are in the hands of professionals you can trust.