The benefits plan is being offered to everyone, from dishwashers on up the ladder. Restaurants need to hire new staff every year, and Salvador is well aware that people will be attracted by the perk.

“I said to Sylvie that in the almost 20 years that we’ve been here, this is the thing we’re probably most proud of, being able to offer this to our staff.”

With many years of experience in the business of group benefits brokerage and consultancy, Crossgrove & Company has helped many operations across a wide range of industries offer their workforce a comprehensive benefits package. Whether it be for the very first time or are looking to improve the efficiency of a plan that's already in place, you're in good hands.

Top 5 HR, benefits, pension and investment stories of the week

Top 5 HR, benefits, pension and investment stories of the week

Crossgrove & Company Inc. provides independent, professional consulting assistance to clientele regarding their employee benefits and insurance programs. As an agent & broker, we provide ongoing customer service which encompasses enrollment, billing, education, and claims dispute resolution. Crossgrove & Company commands the most competitive premiums for its clients year-over year, thereby mitigating the risk of future rate increases brought on by carriers. Contact us today!

A Proactive Approach to Disability Insurance

A Proactive Approach to Disability Insurance

Whether it comes to groups or individuals, Crossgrove & Company ensures that its clients take a proactive approach to coverage. A unique feature of ours is that we offer free consultations to our group client employees in order to educate them on the gaps that may exist between their group coverage and what they may need personally. Contact us today to see what we can do for you!

Bill C-228: What it is and what it means for pensions, if passed

Bill C-228: What it is and what it means for pensions, if passed

Keeping up with legislation and interpreting how it affects you can be a daunting task – that’s where we come in. Talk to one of our experts at Crossgrove & Company and enjoy peace of mind knowing that you’re in the right hands today and in the future.

Employee Benefits: Pandemic changes for both young and old

Employee Benefits: Pandemic changes for both young and old

Whether you’re not far removed from grad school and starting your career or staring down the barrel of retirement, employee group benefits and health insurance should always be a priority. Contact us at Crossgrove & Company to get the right plan at the lowest price.

5 things to know about group benefits

5 things to know about group benefits

At Crossgrove & Company, we review each of our clients’ benefit structure every year in order to identify and communicate trends, areas of improvement and optimization, and cost savings; allowing them to attract and retain quality employees with a group benefits plan that offers each of them the most value possible.

Group Benefits Trends in 2023

Group Benefits Trends in 2023

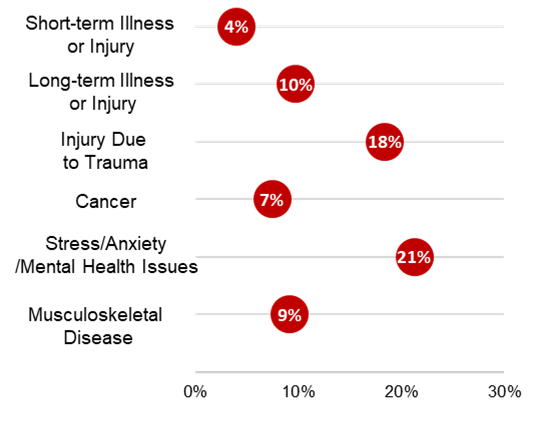

Taking a look at some of the statistics and trends in order to formulate the best course of action for each organziation when it comes to group benefits is a pillar of our operations at Crossgrove and Company. Here are some numbers that organizations and their brokers may want to consider as we enter 2023, as well as an example of how some firms are using current conditions to optimize their group benefits plan.

What's new: Legislative changes to EI sickness and Healthcare Statistics

What's new: Legislative changes to EI sickness and Healthcare Statistics

As part of Budget 2022, the Federal Government is extending Employment Insurance (EI) sickness benefits from 15 to 26 weeks. In addition, the results from this year’s Benefits Canada Healthcare Survey contain many interesting insights. Follow us on our Crossgrove & Company social media platforms (Linked-in, Facebook, Instagram) and our website blog posts for up-to-date information in the field!

How employers can better support employees with rare diseases

How employers can better support employees with rare diseases

Given the challenges Canada is facing when it comes to hiring, employers should be focused on enabling their employees to continue to work and stay healthy. Leveraging opportunities such as partnering on a national rare disease strategy or developing new risk-sharing models for drugs for rare diseases would benefit both plan sponsors and members. With decades of experience in taking a consultant approach to Group Benefits, we at Crossgrove & Company show our clients solutions to problems such as this and more. Contact us today!

Survey finds retirement savings plans key to employee retention

Survey finds retirement savings plans key to employee retention

Six in 10 (60 per cent) U.S. employees say they’re more likely to stay at their current job if their employer offers a retirement savings plan, according to a new survey by Voya Financial Inc. Pension plans are just one of the facets of an organization's benefit mix that we, at Crossgrove & Company, can confidently guide you through.

Canadian employers face conflicting pressures amid a pandemic-driven labour shortage. While inflation, economic volatility and rising costs are squeezing organizations’ budgets, employees also want more from their prospective employers. But with the fierce competition for talent, employers also can’t afford to skimp on employee benefits. At Crossgrove & Company, we bring our clients material savings year over year without sacrificing benefits. Contact us to see what we can do for you and your organization!

Employers seeing paramedical claims return to pre-pandemic levels

Employers seeing paramedical claims return to pre-pandemic levels

As the coronavirus crisis enters an endemic phase, employers are beginning to see a return to pre-pandemic levels in paramedical benefits’ usage. Let us at Crossgrove & Company show you how best to go about premium stability for group benefits in years with high claims.

88% of benefits plan sponsors satisfied with virtual health-care offerings

88% of benefits plan sponsors satisfied with virtual health-care offerings

A majority (88 per cent) of benefits plan sponsors are very (34 per cent) or somewhat (54 per cent) satisfied with their organization’s virtual health-care offerings, up from nearly three-quarters (74 per cent) in 2021, according to the 2022 Benefits Canada Healthcare Survey. Here, at Crossgrove and Company, Member's Health has become a very popular virtual health care service amongst ourselves as well as our clients!

Do you need health and dental insurance in retirement?

Do you need health and dental insurance in retirement?

About 2.2 million Canadians over 65 years old have supplementary health insurance coverage for drugs/dental through individual or group benefit plans, according to the Canadian Health and Life Insurance Association. Still, there are millions left wondering if health and dental insurance are really necessary in retirement – and what options are out there. Acquiring and retaininng quality employees has much to do with the group benefits that an organization offers its employees. Whether you're an employer or an individual, Crossgrove & Company can guide you in making sound, affordable decisions when it comes to health coverage for yourself, your family, and even your employees. Contact us today!

Paramedical benefits sector riding virtual health care wave

Paramedical benefits sector riding virtual health care wave

At the time, virtual physiotherapy might have seemed like a bit of a novelty. But then, roughly half a year later, the coronavirus pandemic arrived in Canada, sending employees to work from home and forcing a sudden change in how benefits were delivered. Virtual physiotherapy — and virtual everything else — was no longer a niche offering. Contact us at Crossgrove & Company to find out about the many Group Benefit options available to you and your organization!

Medavie Blue Cross introduces new group plan option for small businesses

Medavie Blue Cross introduces new group plan option for small businesses

Medavie Blue Cross’s new “Benefits for Small Business” plan provides coverage for extended health care, including vision care, prescription drugs, dental, disability, in addition to life and travel insurance. It is available for small businesses with up to 10 employees in Ontario and Atlantic Canada. As Group Benefit Consultants, we at Crossgrove & Company always have our finger on the pulse of the entire market, allowing us to get you the most suitable and robust plan available while providing you with material savings year over year! Contact us today!

What's the solution to increasing drug-plan costs for plan sponsors?

What's the solution to increasing drug-plan costs for plan sponsors?

"While drug-plan costs are increasing for plan sponsors, the causes for these increases may depend on which part of Canada a plan sponsor resides in." Contact us at Crossgrove & Company to explore the ways in which you and your organization can address the rising costs of drugs for your plan members!

What’s Next In Group Benefits: Meeting Today’s Evolving Employee Needs

What’s Next In Group Benefits: Meeting Today’s Evolving Employee Needs